Key Takeaways

Described here below are the Key Takeaways from the results our TIMES-Be model came up with, and in an ideal world – where all decisions are made with the goal of achieving objectives at minimal societal cost – this is what the world would look like.

Remember, however, what is described here below does not count as a prediction of the future – just as “the best possible world". Our real world will obviously differ from the one here described...

Main Edition 2025 | Key Takeaways

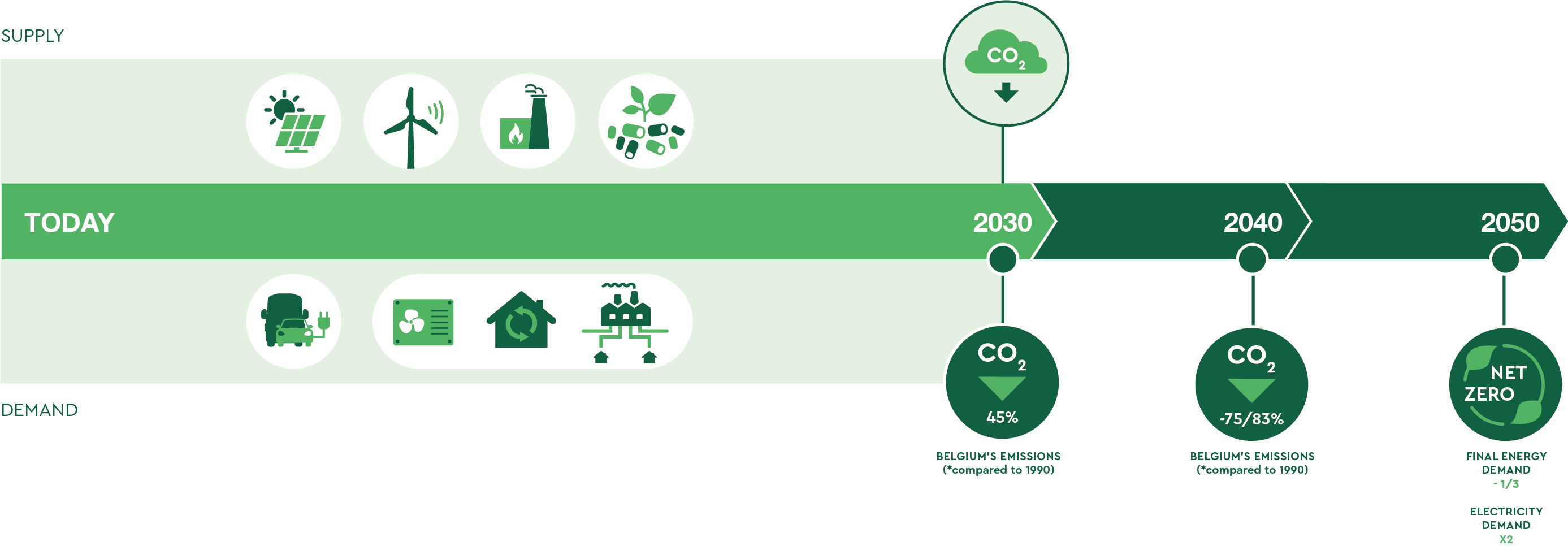

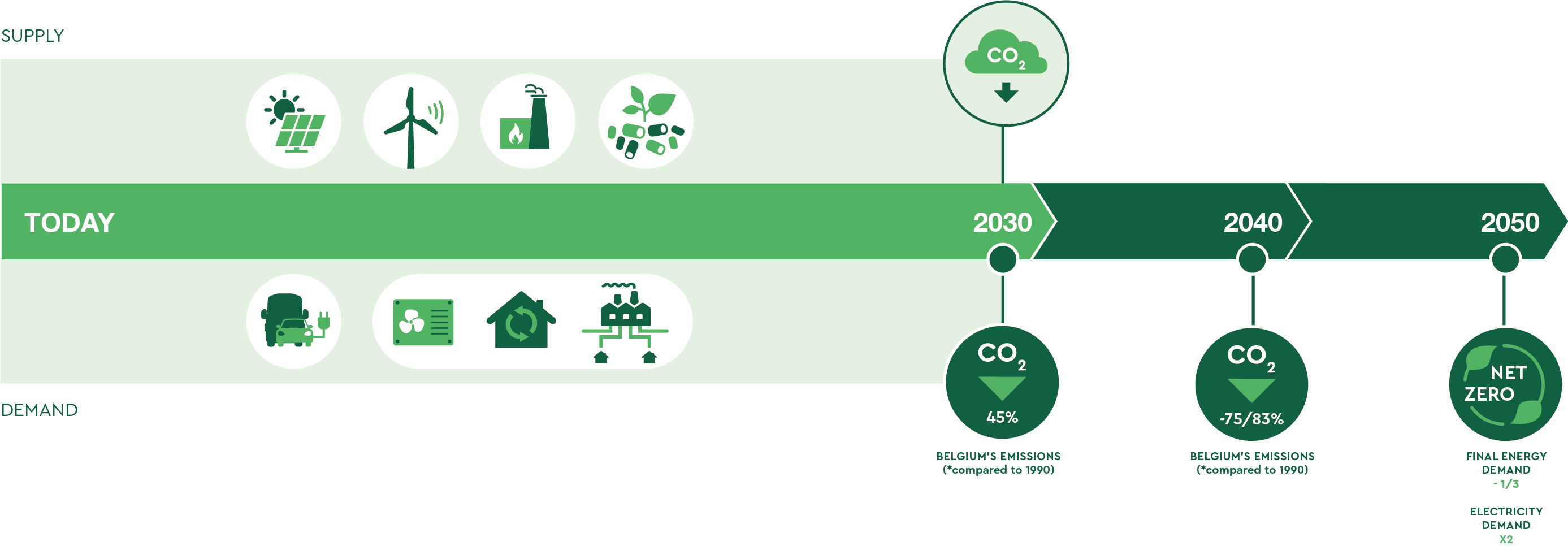

What needs to happen by 2030

• Accelerated electrification of road transport and heating systems for buildings through an increase in the roll-out of electric vehicles and heat pumps, combined with a strong acceleration of the renovation of our buildings.

• Rapid development of wind and solar energy.

• No new installations of fossil heating systems in buildings. Where relevant, expansion of district heating networks. The use of natural gas in industry remains dominant.

• Investments in new gas-fired power plants to support electricity production.

• A clear policy framework for CO2 storage projects such as Kairos@C, Go4Zero, H2BE (blue hydrogen) and others to facilitate an up-scale by 2040. Start building a CO2 backbone.

• A clear policy framework for hydrogen (H₂), based on technological neutrality. The framework must not only define the conditions, but also provide market certainty by clarifying potential consumers of hydrogen.

• If the choice is made to introduce new nuclear energy to be operational by 2040–2045, a strategic plan must be set up as soon as possible with clear agreements on investments, responsibilities for both the private and public sector, permits and locations.

What needs to happen by 2040

• At least 50 percent of non-residential buildings and 80 percent of residential buildings to be heated with heat pumps, where relevant combined with district heating. In addition to electrification, biomethane can play a role in the heating of buildings in densely urbanised areas, where individual heat pumps or district heating are harder to realise in the short term.

• Road transport to be almost fully electrified.

• Direct access to more offshore wind beyond the Belgian North Sea for further electrification of energy demand.

• A clear policy framework for the import of hydrogen and derivatives, and synthetic fuels.

• Greater deployment of batteries and the use of car batteries for both day-night storage and to cover own electricity consumption.

• Carbon capture to reduce emissions from energy-intensive industry gains importance. Pipelines are crucial to transport and store CO2.

What needs to happen by 2050

• Full transition to climate-neutral energy sources in transport and buildings.

• If current industrial output is maintained, it proves cheaper in the long term to develop nuclear capacity for electricity and hydrogen production for industry. Under all three scenarios, the plants run largely at full capacity, but can also respond flexibly to variable production, especially from solar energy.

• International cooperation for the import of hydrogen and derivatives, and synthetic fuels such as ammonia, e-methane, methanol and e-kerosene, which are crucial for sectors such as international aviation and shipping.

• Carbon capture for process and combustion emissions in industry remains at a similarly high level as between 2030 and 2040. Natural gas remains important as an energy source in energy-intensive industry, but its use declines sharply compared to today.

If the above steps are taken in time, the new PATHS2050 study shows that Belgium can effectively be climate-neutral by 2050, with greenhouse gas emissions falling by 45 percent by 2030 and by 75 to 83 percent by 2040, compared to 1990 levels.

Want to dive deeper?

What needs to happen by 2030

• Accelerated electrification of road transport and heating systems for buildings through an increase in the roll-out of electric vehicles and heat pumps, combined with a strong acceleration of the renovation of our buildings.

• Rapid development of wind and solar energy.

• No new installations of fossil heating systems in buildings. Where relevant, expansion of district heating networks. The use of natural gas in industry remains dominant.

• Investments in new gas-fired power plants to support electricity production.

• A clear policy framework for CO2 storage projects such as Kairos@C, Go4Zero, H2BE (blue hydrogen) and others to facilitate an up-scale by 2040. Start building a CO2 backbone.

• A clear policy framework for hydrogen (H₂), based on technological neutrality. The framework must not only define the conditions, but also provide market certainty by clarifying potential consumers of hydrogen.

• If the choice is made to introduce new nuclear energy to be operational by 2040–2045, a strategic plan must be set up as soon as possible with clear agreements on investments, responsibilities for both the private and public sector, permits and locations.

What needs to happen by 2040

• At least 50 percent of non-residential buildings and 80 percent of residential buildings to be heated with heat pumps, where relevant combined with district heating. In addition to electrification, biomethane can play a role in the heating of buildings in densely urbanised areas, where individual heat pumps or district heating are harder to realise in the short term.

• Road transport to be almost fully electrified.

• Direct access to more offshore wind beyond the Belgian North Sea for further electrification of energy demand.

• A clear policy framework for the import of hydrogen and derivatives, and synthetic fuels.

• Greater deployment of batteries and the use of car batteries for both day-night storage and to cover own electricity consumption.

• Carbon capture to reduce emissions from energy-intensive industry gains importance. Pipelines are crucial to transport and store CO2.

What needs to happen by 2050

• Full transition to climate-neutral energy sources in transport and buildings.

• If current industrial output is maintained, it proves cheaper in the long term to develop nuclear capacity for electricity and hydrogen production for industry. Under all three scenarios, the plants run largely at full capacity, but can also respond flexibly to variable production, especially from solar energy.

• International cooperation for the import of hydrogen and derivatives, and synthetic fuels such as ammonia, e-methane, methanol and e-kerosene, which are crucial for sectors such as international aviation and shipping.

• Carbon capture for process and combustion emissions in industry remains at a similarly high level as between 2030 and 2040. Natural gas remains important as an energy source in energy-intensive industry, but its use declines sharply compared to today.

If the above steps are taken in time, the new PATHS2050 study shows that Belgium can effectively be climate-neutral by 2050, with greenhouse gas emissions falling by 45 percent by 2030 and by 75 to 83 percent by 2040, compared to 1990 levels.

Want to dive deeper?

Main Edition 2022 | Key Takeaways

The next few years: little room for additional technology, but preparatory work necessary

The next two years will be characterized by war economy. The structural scarcity of energy – due in part to the war in Ukraine – will hurt economically and financially, and require drastic measures. Development of renewable energy and related infrastructure is a priority, as is renovating the building stock. Investments in the electricity grid and in heat pumps and heat networks will pay off, in conjunction with the phasing out of the gas grid. This will require flexibility: flexibility markets, smart charging and flexibility at the building or industry level.

The 2030 goals: offshore wind, carbon capture and building renovation

Achieving the 2030 goals will mainly require ambitious policies on buildings, investing in infrastructure such as high-voltage grids, but also carbon capture for industry – where carbon is captured and stored or processed so that it does not end up in the atmosphere – and installing renewables, especially wind, as soon as possible. The most economically interesting thing to do is to have oil-fired boilers disappearing from existing buildings even before 2030 and stop further investments in gas boilers. In addition, according to the model, all newly purchased cars are electric. Green hydrogen production, according to the results, plays no significant role before 2030, including in industry.

The 2050 ambitions: counting on innovations, but reasons to be optimistic

It is possible to become climate neutral if offshore wind and solar energy are greatly expanded. To cut the cost, additional access to offshore wind is particularly interesting. The cost can also be reduced by innovations such as small modular nuclear reactors that can play a role as from 2045 onwards (considering that such reactors are still far from market-ready). In the Electrification Scenario, the capacity of these nuclear plants is about the same as the nuclear park before regulatory closures. Without nuclear innovation or other carbon-neutral baseload electricity production, the costs are higher. This is mainly the case because more imports of both electricity and hydrogen are needed for electricity production. In addition, more investments are needed in flexibility options such as smart charging, batteries and green hydrogen plants.

Achieving a climate-neutral Belgium is feasible and affordable

From a technical and societal perspective, a climate-neutral scenario is feasible, and in terms of cost, the energy transition is also affordable. In this study, a comparison was made between climate action and no climate action, and for investments of 2-4% of the gross domestic product (reference 2021), Belgium can become climate-neutral while maintaining its current industrial output. Whether Belgian energy-intensive industries will be able to compete with countries with abundant cheap renewable energy sources is an open question not addressed here. The benefits of climate action – such as fewer natural disasters and a positive impact on air quality and health – were not quantified either.

The next few years: little room for additional technology, but preparatory work necessary

The next two years will be characterized by war economy. The structural scarcity of energy – due in part to the war in Ukraine – will hurt economically and financially, and require drastic measures. Development of renewable energy and related infrastructure is a priority, as is renovating the building stock. Investments in the electricity grid and in heat pumps and heat networks will pay off, in conjunction with the phasing out of the gas grid. This will require flexibility: flexibility markets, smart charging and flexibility at the building or industry level.

The 2030 goals: offshore wind, carbon capture and building renovation

Achieving the 2030 goals will mainly require ambitious policies on buildings, investing in infrastructure such as high-voltage grids, but also carbon capture for industry – where carbon is captured and stored or processed so that it does not end up in the atmosphere – and installing renewables, especially wind, as soon as possible. The most economically interesting thing to do is to have oil-fired boilers disappearing from existing buildings even before 2030 and stop further investments in gas boilers. In addition, according to the model, all newly purchased cars are electric. Green hydrogen production, according to the results, plays no significant role before 2030, including in industry.

The 2050 ambitions: counting on innovations, but reasons to be optimistic

It is possible to become climate neutral if offshore wind and solar energy are greatly expanded. To cut the cost, additional access to offshore wind is particularly interesting. The cost can also be reduced by innovations such as small modular nuclear reactors that can play a role as from 2045 onwards (considering that such reactors are still far from market-ready). In the Electrification Scenario, the capacity of these nuclear plants is about the same as the nuclear park before regulatory closures. Without nuclear innovation or other carbon-neutral baseload electricity production, the costs are higher. This is mainly the case because more imports of both electricity and hydrogen are needed for electricity production. In addition, more investments are needed in flexibility options such as smart charging, batteries and green hydrogen plants.

Achieving a climate-neutral Belgium is feasible and affordable

From a technical and societal perspective, a climate-neutral scenario is feasible, and in terms of cost, the energy transition is also affordable. In this study, a comparison was made between climate action and no climate action, and for investments of 2-4% of the gross domestic product (reference 2021), Belgium can become climate-neutral while maintaining its current industrial output. Whether Belgian energy-intensive industries will be able to compete with countries with abundant cheap renewable energy sources is an open question not addressed here. The benefits of climate action – such as fewer natural disasters and a positive impact on air quality and health – were not quantified either.

Main Edition 2022 | Full-Fledged Report

While the complete results of our study can be found here on our online PATHS2050 Platform, this didn’t stop our researchers from putting pen to paper to equally produce a full-fledged report, which – in a more descriptive manner – outlines and details investment pathways to reach the 2050 climate targets, including a detailed description of the model setup, the scenarios and the assumptions used.

After an elaborate introduction in Section 1, this report starts out with describing the TIMES modelling framework and – more specific – the TIMES-BE model in Section 2. In Section 3, more background on the storylines and scenarios is presented. Section 4 covers in more detail the demands or production rate, the structure of the base year, the processes implemented in TIMES-BE, as well as the main macroeconomic assumptions. In Section 5, we briefly explain the structure of the power generation sector and the power grid, as well as refineries and the future production of molecules. This chapter includes energy carriers’ price projections and availability of resources. Section 6 discusses the results of the main scenarios. Section 7 then presents the results of sensitivity cases derived from the three main scenarios, exploring the uncertainty of certain assumptions in the model. Finally, in the Conclusion & Discussion Section, we provide a more general analysis of our study’s results, and provide specific conclusions and policy implications.

While the complete results of our study can be found here on our online PATHS2050 Platform, this didn’t stop our researchers from putting pen to paper to equally produce a full-fledged report, which – in a more descriptive manner – outlines and details investment pathways to reach the 2050 climate targets, including a detailed description of the model setup, the scenarios and the assumptions used.

After an elaborate introduction in Section 1, this report starts out with describing the TIMES modelling framework and – more specific – the TIMES-BE model in Section 2. In Section 3, more background on the storylines and scenarios is presented. Section 4 covers in more detail the demands or production rate, the structure of the base year, the processes implemented in TIMES-BE, as well as the main macroeconomic assumptions. In Section 5, we briefly explain the structure of the power generation sector and the power grid, as well as refineries and the future production of molecules. This chapter includes energy carriers’ price projections and availability of resources. Section 6 discusses the results of the main scenarios. Section 7 then presents the results of sensitivity cases derived from the three main scenarios, exploring the uncertainty of certain assumptions in the model. Finally, in the Conclusion & Discussion Section, we provide a more general analysis of our study’s results, and provide specific conclusions and policy implications.

Background of Model Calculation

The EnergyVille TIMES-Be model

The open source TIMES modelling framework is developed and maintained within the ETSAP technology collaboration program of the IEA - International Energy Agency – and the current version of our EnergyVille TIMES-Be model is the result of more than 30 years of experience in developing energy system optimisation models.

Thanks to the model updates realised in and supported by the FPS Economy Energy Transition Fund projects EPOC, BREGILAB, PROCURA, TRILATE, Be-HyFE, CIREC and others, we are now in a position to present the most detailed, bottom-up, technology rich, full system optimization model of the Belgian energy system to date – an unprecedented endeavour made possible due to our ability to take into account all three of these crucial system optimization model characteristics:

Cross-vector: covering both energy use – in the form of fossil fuels, renewables, clean molecules and electricity – and feedstock.

Cross-sector: covering all supply – refineries and the power sector – and end-use demand sectors: industry, residential, commercial, transport and agriculture sectors.

Cross-border: covering both projected and time-sliced import-export cost curves for electricity from other EU countries, and possible import of clean molecules.

Additionally, just as the energy transition is exactly that – a transition and a work in progress – so is this PATHS2050 Platform continuously in transition and a work in progress. As such, we continuously identify further areas of improvement, all of which can be found in the detailed report we wrote for our Main Edition 2022, covering our assumptions, sector details and sources, to be found here above.

Major model improvements for the Main Edition 2025

Since the launch of PATHS2050 in 2022, the TIMES-Be model has seen major updates, based on discussions and input from stakeholders:

All costs are updated or discounted towards EUR2024 values.

The International maritime and aviation sectors are added to the net-zero target by 2050, accordingly to EU policy ambitions.

The residential buildings sector has been updated, with a new more detailed structure, renovation measures and costs.

Carbon Capture and Storage technologies and prices have been detailed per industry sector/process based on CO2 concentration and flue gas volumes, while identifying different capture technologies. Furthermore the transport and storage of CO2 has been detailed.

Import prices for hydrogen and derivatives are higher and updated using more recent international literature sources, except for the IMPORTS scenario.

- Biomass, biogas and biomethane potential (locally available + imported) for Belgium has been updated to increase from 22 TWh in 2022 to 43 TWh/a by 2050.

- Ammonia can be fully imported in Belgium from 2040 onwards, replacing the local production if this would be cost-efficient. Import of sponge iron is not allowed.

- An assumption for the increase of electricity use for data centers (presented in the commercial sector) has been exogenously included, increasing from 2 TWh in 2020 to 12 TWh by 2050.

CO2 vs Greenhouse Gas emissions

According to Belgium’s Greenhouse Gas Inventory (1990-2022), CO2 emissions account for more than 85% of all Belgian emissions. Those are the emissions our EnergyVille TIMES-Be model accounts for - not the other GHG emissions such as CH4, N2O or F-gases.

Scope 1, 2 & 3 CO2 emissions

Within the realm of those CO2 emissions, the Greenhouse Gas Protocol foresees a categorisation of three types – or scopes – of these CO2 emissions:

Scope 1 CO2 emissions are direct emissions from company-owned and controlled resources: emissions that are released into the atmosphere as a direct result of a set of activities at a firm’s level. They include stationary CO2 combustion, mobile CO2 combustion and process CO2 emissions. These Scope 1 CO2 emissions are the CO2 emissions our EnergyVille TIMES-Be model accounts for.

Then there are also Scope 2 (owned indirect) CO2 emissions: CO2 emissions that a company causes indirectly when the energy it purchases and uses is produced. Scope 2 CO2 emissions from imported electricity are covered in our EnergyVille TIMES-Be model, but not reported for these three scenarios.

Finally, there are Scope 3 (unowned indirect) CO2 emissions: CO2 emissions a company is indirectly responsible for, up and down its value chain. These Scope 3 (unowned indirect) CO2 emissions are not covered in the current version of our EnergyVille TIMES-Be model.

The EnergyVille TIMES-Be model

The open source TIMES modelling framework is developed and maintained within the ETSAP technology collaboration program of the IEA - International Energy Agency – and the current version of our EnergyVille TIMES-Be model is the result of more than 30 years of experience in developing energy system optimisation models.

Thanks to the model updates realised in and supported by the FPS Economy Energy Transition Fund projects EPOC, BREGILAB, PROCURA, TRILATE, Be-HyFE, CIREC and others, we are now in a position to present the most detailed, bottom-up, technology rich, full system optimization model of the Belgian energy system to date – an unprecedented endeavour made possible due to our ability to take into account all three of these crucial system optimization model characteristics:

Cross-vector: covering both energy use – in the form of fossil fuels, renewables, clean molecules and electricity – and feedstock.

Cross-sector: covering all supply – refineries and the power sector – and end-use demand sectors: industry, residential, commercial, transport and agriculture sectors.

Cross-border: covering both projected and time-sliced import-export cost curves for electricity from other EU countries, and possible import of clean molecules.

Additionally, just as the energy transition is exactly that – a transition and a work in progress – so is this PATHS2050 Platform continuously in transition and a work in progress. As such, we continuously identify further areas of improvement, all of which can be found in the detailed report we wrote for our Main Edition 2022, covering our assumptions, sector details and sources, to be found here above.

Major model improvements for the Main Edition 2025

Since the launch of PATHS2050 in 2022, the TIMES-Be model has seen major updates, based on discussions and input from stakeholders:

All costs are updated or discounted towards EUR2024 values.

The International maritime and aviation sectors are added to the net-zero target by 2050, accordingly to EU policy ambitions.

The residential buildings sector has been updated, with a new more detailed structure, renovation measures and costs.

Carbon Capture and Storage technologies and prices have been detailed per industry sector/process based on CO2 concentration and flue gas volumes, while identifying different capture technologies. Furthermore the transport and storage of CO2 has been detailed.

Import prices for hydrogen and derivatives are higher and updated using more recent international literature sources, except for the IMPORTS scenario.

- Biomass, biogas and biomethane potential (locally available + imported) for Belgium has been updated to increase from 22 TWh in 2022 to 43 TWh/a by 2050.

- Ammonia can be fully imported in Belgium from 2040 onwards, replacing the local production if this would be cost-efficient. Import of sponge iron is not allowed.

- An assumption for the increase of electricity use for data centers (presented in the commercial sector) has been exogenously included, increasing from 2 TWh in 2020 to 12 TWh by 2050.

CO2 vs Greenhouse Gas emissions

According to Belgium’s Greenhouse Gas Inventory (1990-2022), CO2 emissions account for more than 85% of all Belgian emissions. Those are the emissions our EnergyVille TIMES-Be model accounts for - not the other GHG emissions such as CH4, N2O or F-gases.

Scope 1, 2 & 3 CO2 emissions

Within the realm of those CO2 emissions, the Greenhouse Gas Protocol foresees a categorisation of three types – or scopes – of these CO2 emissions:

Scope 1 CO2 emissions are direct emissions from company-owned and controlled resources: emissions that are released into the atmosphere as a direct result of a set of activities at a firm’s level. They include stationary CO2 combustion, mobile CO2 combustion and process CO2 emissions. These Scope 1 CO2 emissions are the CO2 emissions our EnergyVille TIMES-Be model accounts for.

Then there are also Scope 2 (owned indirect) CO2 emissions: CO2 emissions that a company causes indirectly when the energy it purchases and uses is produced. Scope 2 CO2 emissions from imported electricity are covered in our EnergyVille TIMES-Be model, but not reported for these three scenarios.

Finally, there are Scope 3 (unowned indirect) CO2 emissions: CO2 emissions a company is indirectly responsible for, up and down its value chain. These Scope 3 (unowned indirect) CO2 emissions are not covered in the current version of our EnergyVille TIMES-Be model.